Bonus pay is a critical segment of one’s total compensation in the financial sector in general and hedge funds in particular. It is not uncommon for those in the highest pay bands to earn bonus pay that is many multiples of their base salary. Predictably, the percentage of one’s total compensation represented by bonus pay decreases markedly for those in the lower pay bands. For example, the 2016 Hedge Fund Compensation Report survey reports that hedge fund professionals earning $50 thousand to $150 thousand in total compensation received, on average, bonus pay amounting to 16.5 percent of their total compensation. This stands in sharp contrast to the 67 percent earned in bonus pay by those with total compensation in the $500 thousand to $1 million range.

Just Starting Out?

For obvious reasons, those beginning a career in the hedge fund industry need to negotiate for the heftiest base salary possible. As the statistics above demonstrate, the odds are not in favor of bonus pay making a significant impact in one’s overall compensation when one is just starting his career. In other words, don’t make the mistake of settling for a less than adequate base salary thinking the shortfall can be made up in bonus pay. It won’t, unless one is starting near the top, which most will not.

Bonus Pay Is Important But…

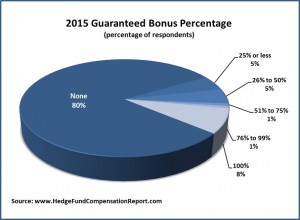

While bonus pay is an important component of the total compensation package, those just beginning their hedge fund career will never see the huge bonuses that politicians have been using as fodder for their income inequality talking points. The fact is, most hedge fund professionals do not receive a guaranteed bonus and of the 20 percent who do, only 8 percent receive a 100 percent guarantee. And, according to the 2016 survey, a significant percentage of those receiving bonuses are required to reinvest some portion of their bonus in the firm. With 80 percent of bonuses falling into the discretionary bucket, the newbie is well-advised to focus negotiations on achieving the best possible base salary.

The Big Picture

Bonus pay can be function of individual performance, firm performance or, as is most often the case, a combination of both. Therefore, it is important for those entertaining a career as a hedge fund professional to understand the potential impact of back-to-back years of poor performance is likely to bring to bear on future hedge fund bonus pay.

Because many firms operate with stipulations that prevent hedge funds from earning a performance fee until investor losses are recouped, the probability of the hedge funds having the performance fee income stream to fund robust bonus pay is diminishing. This, coupled with the increased potential for redemptions, could compromise assets under management reducing the management fee income stream as well.

This is borne out in Prequin’s 2016 Global Hedge Fund Report which found that 32 percent of investors surveyed planned to decrease capital investment in hedge funds, while only 25 percent were considering an increase.

Final Thoughts

No one should abandon their dream of a hedge fund career based on this information. Instead, adopt a realistic attitude with respect to compensation expectations, especially in terms of bonus pay. The year 2016 will be a critical one for hedge funds. This performance trend must be reversed, because investors are clearly growing impatient.

Comments on this entry are closed.