Some industry insiders would bluntly respond – yes, the mom-and-pop hedge fund pitches from small managers have had their day; regulations will push the start-up capital requirements beyond what small, successful family businesses and other wealthy individuals can do on their own, not to mention the bright, but poor, potential money managers who have good ideas with strong, back-tested results, but very little in assets under management.

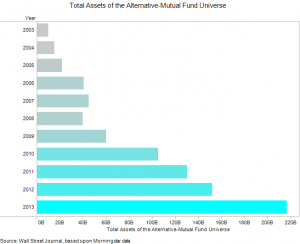

In contrast to the pessimistic point of view (unless, of course, you are a large hedge fund or money manager wanting to keep competition out of the money management business), some will point to the incredible growth in alternative-investment mutual funds and other hedge fund-type investments as a sign that the universe could continue to have a bright future for all types of hedge fund managers, including small ones, regardless of Financial Industry Regulatory Authority’s (FINRA) desire to make it harder for the small guys to market to potential investors.

Interestingly, based upon a review of the Wall Street Journal’s (WSJ) recent article “Mom-and-Pop Pitches Draw Fire“, the WSJ appears to be on the side of more regulation. For instance, FINRA’s Brad Bennett is quoted as saying, when referring to pitches hedge fund managers sometimes make to the supposed “idiot” mom-and-pop investors, “With these things [referring to alternative-investment classes], it can be like giving a 6-year old a circular saw. Most mom-and-pop investors don’t understand the risks they’re taking.”

Other quoted individuals include Massachusetts’ William Galvin, who said “Our concern is there’s a different atmosphere now. Regulations have been eased on advertising, and these firms are using more aggressive sales tactics”; and Heath Abshure, Arkansas’s securities commissioner and president of the North American Securities Administrators Association is quoted, referring to alternative-investments, as saying “[they are] one of our biggest investment problems, and all our members are looking at them.”

To some, comparing potential investors in alternative-investments to giving a six year old a circular saw is quite goofy, with FINRA either trying to protect itself from supposed socially benevolent government regulators or acting as the front to protect large investment firms’ business, who have the resources to address the more stringent marketing requirements of their hedge funds to mom-and-pop investors. Both are likely causes behind a “potential crackdown” on certain alternative-investment firms, most of which, no doubt, will be small investment firms (although the big firms will be the ones mentioned in the media).

Others, on the other hand, certainly view the potential investor as an ignorant chump, incapable of evaluating various investment pitches or strategies. This group includes such people as many elected government officials, government bureaucracies, and several of the large asset management firms. The winner of this regulation tussle is unlikely to be the small investment start-up or the consumer, who, in the end pays for the increased regulatory costs.

The hedge fund industry has long been a welcoming arena for bright individuals to get into the money management industry. Whether that will continue to be the case depends on regulation attitudes and openness of investor demand to new managers with less of a track record. Should more open-mindedness and freedom to do business win what right now looks like a losing battle, small hedge funds will likely continue to have a bright future.

Comments on this entry are closed.