On Thursday the U.S. Bureau of Labor Statistics released its first count of initial and continuing unemployment insurance claims for the prior week. The initial claims figures came in at 333K, an increase of 5K over the prior week’s revised figure of 328K. Although the most recent initial claims figures bumped up, many “trend” analysts pointed to the 6K decline in the four week moving average as a sign that the labor market continues to improve.

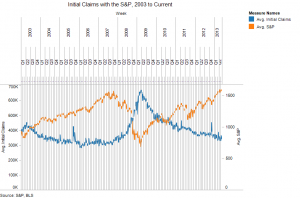

In terms of recent history, initial claims have been on an improving trend since peaking in early 2009. Not coincidentally, over the same time frame financial markets have experienced a strong bull market, with, for instance, the S&P 500 up about 250 percent.

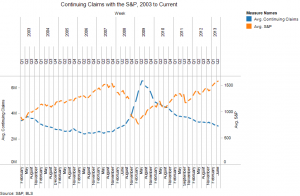

On continuing claims, the figures also came in higher, up 67K over the prior week’s 2.951 million. As with the initial claims figures, a good deal of financial analysts and labor market observers pointed to the 2K decline in the four week moving average as a sign that the labor market is moderately improving.

The now four year improvement in the initial and continuing claims figures might make some financial observers wonder: have initial claims bottomed out or are they close to bottoming out? The bottoming out question is certainly valid, given that claims are getting close to where they bottomed out at during the 2004 to 2007 boom years. How much lower could claims actually go?

With this background in mind, what do the initial and continuing claims figures have to do with hedge funds? The connection is this. If initial claims are getting close to bottom, then that implies that financial markets have some rough waters ahead. With rough water ahead, which types of money managers are most likely to steer through the storm the best? With some exceptions, the answer, at least when it comes to managing money in highly liquid markets, is hedge fund managers.

This is interesting because many investors have been wondering whether it is time to pull assets from the hedge fund industry, which has generally underperformed competing asset classes over the last few years. Essentially, after a few years of under-performance, investors may start to shift money away from the hedge fund industry, exactly at the time when it would be best to shift money towards the hedge fund industry.

The crux of the issue, though, is whether the initial and continuing claims figures are close to bottoming out. If you look at the two figures above, it’s hard to see the labor market figures continuing to improve much more for much longer.

Interestingly, the question comes down to whether investors will start to view their asset allocation strategies like the way hedge fund money managers do, at a time when they are wondering whether hedge funds are worth the money.

Comments on this entry are closed.