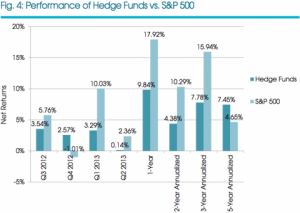

On the one hand are individuals pointing out that, on a year-to-date basis, hedge funds as a whole are under-performing market indices such as the S&P 500. This general observation is reflected below, based upon data provided by the analytics firm Prequin. As a whole, through the second quarter of 2013, hedge funds gained 0.14 percent while the S &P 500 was up 2.36 percent.

The Prequin report also provides the justification as to why some clients are losing confidence in the industry on a longer term basis, with the S&P 500 outperforming the hedge fund industry as a whole by almost 6 percent on a two-year annualized basis and by around 8 percent on a three-year annualized basis.

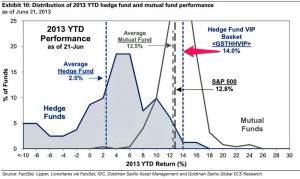

On the other side of the “has it been a good year to be a hedge fund manager” question is evidence, such as that provided by Goldman Sachs, that hedge fund managers have actually been very good stock pickers this year. Their evidence is summed up in the following figure:

The above graphic shows the distribution of hedge fund returns by year-to-date (YTD) return. As is shown, around 5 percent of hedge fund managers beat the S&P 500 index (to get to the 5 percent figure, add all the blue shaded area beyond the black dotted line titled “Average Mutual Fund Return”). What’s interesting, though, is the blue dotted line titled “Hedge Fund VIP Basket” (pointed at by the pink arrow). The Hedge Fund VIP Basket line shows the YTD return of what Goldman Sachs calls the Hedge Fund Very Important Position list.

According to David Kostin of Goldman Sachs:

Interestingly, hedge fund long stock positions have actually delivered solid returns in 2013. Our Hedge Fund Very-Important-Position (VIP) List has returned 14 percent YTD (Bloomberg ticker: <GSTHHVIP>). The basket consists of the 50 stocks that “matter most” for hedge fund returns in terms of weight in a typical hedge fund portfolio. Unfortunate selection of short positions has hampered hedge fund returns, with 26 of the 50 Russell 3000 stocks with a market cap of at least $1 billion and the most short interest as a percentage of market cap posted returns of more than 20 percent during the first half of 2013.

In essence, the aggregate hedge fund return figures with all strategy types lumped into one index return figure only tells a small part of the story. If one takes out short strategies and other apples to oranges comparisons, hedge fund managers with long stock positions generally look pretty good against the S&P 500, with the top 50 hedge fund long positions up 14 percent through the first half of 2013 compared to 12.8 percent for the S&P 500.

Overall, investor concerns that the hedge fund industry isn’t worth its cost depends on whether apples are being compared to apples. In this cited attempt at making an apples-to-apples comparison, hedge fund managers’ picks for 2013 look pretty good compared to the S&P 500.

Comments on this entry are closed.