On Friday the U.S. Labor Department reported a total of a 195K net new jobs created for the month of June.

The June jobs report’s 195K net new jobs figure matches exactly the revised May figure and is 4K lower than the April new jobs number of 199K.

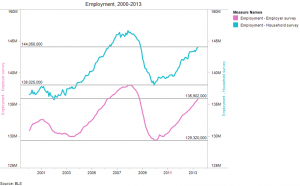

Overall, since bottoming out in late 2009/early 2010, total new jobs created is 6 million based on the household survey and 6.5 million based on the employer survey.

The market responded positively to the employment report, with the Dow and S&P 500 both up about 1 percent.

But, what does the June jobs report mean for the hedge fund industry outlook?

On the surface there are only two possible effects that the June jobs report can have: either a positive effect or a negative effect.

A positive effect would mean that individuals demanding the services of hedge fund industry professionals view the jobs report as a sign that equity markets are on the way up and that hedge fund managers are more likely to beat the market compared to mutual fund or other type of money managers.

Individuals with this view may employ the services of hedge fund managers that double down (or more) on their investments through the use of margin trading.

Other clients falling into the positive effect area are those clients who employ the absolute return aspect of certain hedge fund mangers. Essentially, if you believe the June jobs report equates to growth-stunting Federal Reserve policy moves, then one of the best ways to protect capital is to shift money to absolute return hedge fund mangers.

A negative effect would mean that individuals, on the whole, think that positive economic news makes it less likely for hedge fund mangers to beat the market. Essentially, hedge fund manger fees are unjustified.

How did the market initially see the effect of the June jobs report on the hedge fund industry?

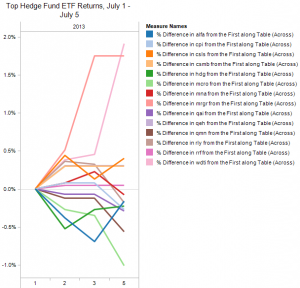

In looking at the returns of the top ETF hedge funds, the market reaction was, not surprisingly, mixed, as is evidenced by the following figure showing returns from July 1 to July 5th.

The actual empirical analysis would require too much econometric analysis for its worth, so without digging too much into the details of each of the ETF hedge funds returns, the simple answer to the question is: it’s too early to tell and the hedge fund industry is too diverse to answer such general questions as that posed to start this article.

Overall, the June jobs report could end up having a positive or negative overall effect on the hedge fund industry. The initial reaction, based upon publicly traded hedge fund firms was mixed.

Comments on this entry are closed.