Over the past few years, a number of new trends have shown up in the hedge fund industry. Among the changes are generally increased fund size to get a hedge fund up and going, increased compliance costs, and pressure for lower management fees. This article addresses the increased size bias.

Hetty MacIntyre, in a recent interview with Business Insider columnist Brian Dechesare, gave some background on the issue. When asked about the amount of capital needed to get a hedge fund off the ground, she gives a $250 million mark for “institutional quality funds”. Does this mean that the days of starting a hedge fund in your home office with a cobbled-together $1 million from friends and family are over? According to MacIntyre – yes. In fact, according to MacIntyre, not only is the small hedge fund start-up gone, so is the medium sized manager who has $20 to $50 million in assets under management. With this shift towards larger size bias in mind, one might ask: is this good for the future of the hedge fund industry?

In answering this question, one would likely need to look at the observed and yet-to-be observed statistics of industries that become less welcoming of small entrepreneurs (i.e. will financial innovation suffer?), as well as look at cash inflow and outflow of hedge funds compared to other asset classes and the associated historical returns (i.e. will expected returns be lower?). On one part of the answer – cash inflow – the increased size bias does not appear to be having a detrimental effect on the revenue side of the hedge fund industry’s balance sheet, with the most recent figures for the first quarter of 2013 indicating that hedge funds continue to grow, with current assets under management at an all-time high. In the first quarter, hedge funds worldwide managed $2.375 trillion, up $122 billion over the fourth quarter of 2012 and representing the fastest growth rate since 2010 (as a note of reference, total estimated assets under management in 1994 was $1.1 trillion).

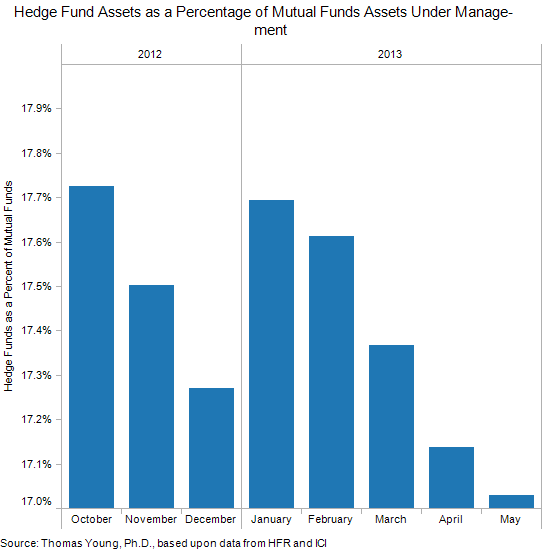

Of course, nominal cash inflow isn’t multivariate regression analysis or some other empirical method, but it does show that in the short term, the hedge fund industry isn’t suffering from the increased size bias, or at least not losing investment cash inflow. Although the hedge fund industry isn’t decreasing in net investor cash flow, the story is a little different when comparing the hedge fund industry’s take of the total investor cash inflow pie, with the hedge fund industry’s take declining somewhat from the peak year of 2007.

A second component of the answer to the question of whether size bias is good for the hedge fund industry is the effect on financial innovation. As a general rule, greater entry requirements in competitive industries, such as financial services and asset management, puts downward pressure on innovation. Interestingly, it’s not government regulation per se (although increased compliance costs hurt small businesses disproportionately) that is imposing greater entry requirements. Instead, it’s the demand side of the equation.

Essentially, institutions and families with enough money to invest in hedge funds are demanding managers with a greater amount of assets under management. The skittishness on the demand side may shift around, but it hasn’t happened yet, and financial innovation may suffer as a result.

In addition to looking at the adverse effect on financial innovation and cash inflow, one would need to address expected returns. As a general rule, the smaller the hedge fund, the higher the risk, but also the higher the expected return (again, just a general rule with numerous exceptions).

Lastly, the increased size bias also has a demographic side to it. Essentially, by moving business towards currently established industry professionals and institutions, the industry and its clients create an “old-man” bias, which certainly benefits the older demographic at the expense of the younger generation.

In all, over the past few years, potential hedge fund clients have shifted bias towards larger hedge funds, with institutional quality funds perhaps having an unwritten minimum of around $250 million in assets under management. Whether this is actually good for the industry is up for debate.

Comments on this entry are closed.