Hedge fund returns are in the red for the first time this year, with an average reported negative gain of 0.75% in June. The Federal Open Market Committee’s (FOMC) decision against an increase in the Fed Funds rate is perceived by many to be the principal driver behind the current bull market and, incredibly, the primary cause of poor performance across the hedge fund industry.

She Loves Me, She Loves Me Not

Janet Yellen, Chair of the FOMC, has alternately put a rate hike on the table and taken it away, in much the same way lovers play the old French game of ”she loves me” … “she loves me not”. However, Yellen seems to be plucking petals from an ox-eye daisy while alternating the phrases, “rate hike … no rate hike.”

Yellen’s version of the game may not be one of the heart as much as it is of heart attacks! Many would argue that the unnatural direction of the markets is fueled by this prolonged period of near zero interest rates and has wreaked havoc on hedge fund returns. While this may or may not be the case, the FOMC’s rhetoric and perceived indecisiveness on the subject of a rate hike may certainly be a contributing factor.

We Have a Short Memory

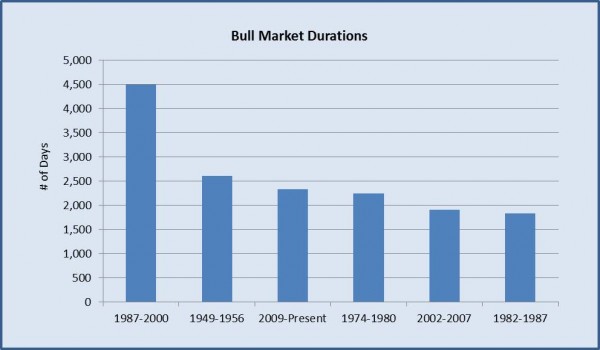

This most recent bull market has been on-going for 2,331 days—6 years, 4 months and 18 days. And while it is true that investor’s jitters increase proportionately to the duration of the bull market, this one comes in at a distant third among the 6 bull runs we have had since 1949.

In fact, the average bull market has lasted 2,571 days, which means this run is below average in terms of duration.

The trajectory of the current bull market seems assured to result in a second place finish, at the very least. It is improbable that a modest rate hike announcement would end the current bull market. That would require at least a 20% drop from its high (currently 18,351.40) and few would support the contention that such a hike would result in the Dow plummeting to 14,681.12.

Facing Facts

Hedge funds have not been meeting expectations. Returns, in the aggregate, are unimpressive. Short and long/short are not optimum strategies in a bull market. Add to this the uncertain direction of interest rates, currency valuations, oil gluts, ECB policies, China’s slowdown and geopolitical turmoil and anyone can grasp why hedge fund managers are having challenges.

Hedge Fund Jobs

When hedge fund performance is reported in the aggregate, or as an average of all funds and strategies, the outliers are short-changed. Hundreds of hedge funds that have performed extraordinarily well in this hostile climate and no one should lose sight of that fact.

Those who seek a career in hedge funds should not be discouraged by the barrage of statistical data which seeks to diminish the industry. Don’t be misled. Hedge funds have a key role to play in the financial system. Although the perception of hedge fund ineptness is being fostered in some circles, the truth is the industry is simply being painted with the proverbial “broad-brush.”

Always remember it is never the goal of any hedge fund to beat a market index. Rather the goal is to make the most of investment opportunities while preserving capital.

{ 1 trackback }

Comments on this entry are closed.