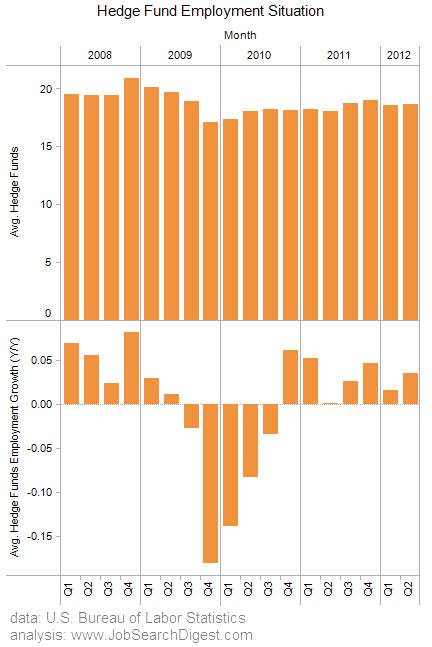

Employment at a hedge fund is for many professional money managers the highpoint of their careers, or at least a very good stepping stone. So, on the whole, how many jobs were created, net of being destroyed, by the hedge fund industry in the current year compared to the previous year? Through the second quarter of 2012 that figure comes out to be 3.5 percent.

The second quarter growth rate represents acceleration from the first quarter growth rate of 1.6 percent. On a longer term basis, hedge fund employment is still down from its pre-recession peak of over 21,000 in the fourth quarter of 2008. At its current growth rate, employment in the hedge fund industry will reach its all-time high in about 3 years, or 2015.

The second quarter growth rate represents acceleration from the first quarter growth rate of 1.6 percent. On a longer term basis, hedge fund employment is still down from its pre-recession peak of over 21,000 in the fourth quarter of 2008. At its current growth rate, employment in the hedge fund industry will reach its all-time high in about 3 years, or 2015.

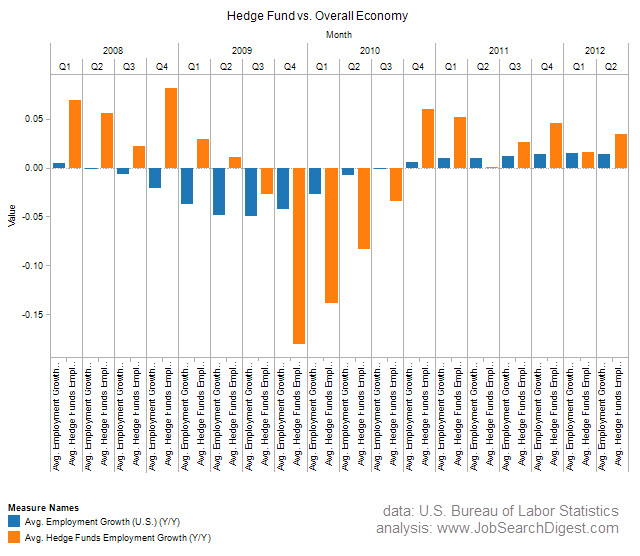

Shifting to comparing the hedge fund industry to the growth rate in overall employment, the hedge fund industry is besting the overall economy’s employment growth rate by about two and a half times (3.5 percent versus 1.4 percent). In fact, as the comparison chart shows, hedge fund employment growth has bested the overall economy in each of the past seven quarters, with the exception of the second quarter of 2011. The greater growth rate in hedge fund employment in a recovery is expected because hedge fund employment is much more cyclical than the overall economic base.

Professional analysts also expect hedge fund employment to decline quicker than the overall economic base during a downturn, as is always the case. For instance, employment growth in the hedge fund industry declined for five consecutive quarters during the recession; the growth rate declines seen from the third quarter of 2009 to the fourth quarter of 2010 topped more than 15 percent at one point, with overall employment declining by almost 4,000 jobs on a year over year basis.

Why does hedge fund employment decline faster than the overall economy and grow faster during an upturn? Simple, money moves much faster among financial professionals than it does among industrial businesses. Basically, investors put money into and take money out of hedge funds very quickly – thus, hedge funds are born and die much quicker than say a tire manufacturer.

What does all this portend for the future of hedge fund employment? The answer to this question largely depends upon the investors’ confidence in the ability of the industry to outperform competitors, with the largest competitor being mutual funds attempting to mimic certain hedge fund strategies.

What does all this portend for the future of hedge fund employment? The answer to this question largely depends upon the investors’ confidence in the ability of the industry to outperform competitors, with the largest competitor being mutual funds attempting to mimic certain hedge fund strategies.

As long as the hedge fund industry continues to provide risk diversification and returns above the industry mean (the industry as a whole, not just one specific hedge fund), the industry is likely to continue to gain ground on other providers of money management services. If you are able to hand the stress and pressure of working in the ultra-competitive world of money management, there’s no better place than the hedge fund industry this year.

Comments on this entry are closed.