February appears to mark the end of 14 consecutive months of positive gains for the hedge fund industry, with HFRX weighted average returns posting a decline (- 0.35 percent) as the surge in market volatility worked its worst in hedge funds.

While the HFRX is much narrower in its scope than the HFRI, which comprises thousands of funds, it is unlikely that the HFRI, when released, will produce a positive number for the industry.

Performance Aside

Neither performance, assets under management or fee pressures will deter hedge funds from recruiting candidates with a great skill-set in mathematics and the hard-sciences, particularly engineers and developers. Quantitative skills are in demand, and while they will not guarantee a job, such attributes will put these job seekers at the front of the queue.

Demand for quantitative traders and analysts are on the rise. This is equally true for programmers experienced in MattLab, SQL, Java, Hadoop, Q, kdb+, C#, C++, HTML5, Python and other programming languages.

Additionally, a number of fundamental hedge funds are moving in a “quantamental” direction, hiring data scientists from academia and Silicon Valley, to better evolve with the times. This includes recruiting those experienced in not only data science, but also artificial intelligence, machine learning and other disciplines with a quantitative bent, to aid portfolio managers in making better investment decisions.

Well-Rounded

However, having the bona fides enumerated earlier, does not guarantee a successful placement in the hedge fund industry, or any other industry. Other attributes are also important, such as communication skills, interpersonal skills and overall intelligence.

Other Disciplines

The evolving nature of the hedge fund industry gives rise to opportunities for those who excel in a wide variety of endeavors. For example, the recent passage of the Tax Cuts and Jobs Act of 2017 may create opportunities for those in the legal profession. Extraordinary geopolitical events could lead to employment opportunities for those skilled in geopolitics, political science, and world history.

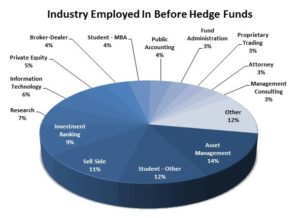

The variety of educational and employment backgrounds that already exist in the hedge fund industry are astounding. One need look no further than the 2018 Hedge Fund Compensation Report to see the myriad backgrounds from which hedge fund professionals originate.

The Takeaway

Hedge funds, which are known for innovation and evolution, are not merely a home for stock pickers and number crunchers. Successful hedge funds rely upon a host of experts in a variety of disciplines to achieve successful outcomes for their investors.

As the chart demonstrates, hedge fund professionals join the industry from technology, the law, public accounting, consulting, research, and many other fields. When you contemplate the existence of around 10,000 hedge funds employing many more thousands of people, it is not difficult to see the wealth of employment opportunities that exist in the hedge fund industry.

Anyone interested in a hedge fund job should carefully consider the juxtaposition of his or her skill set to a job in a hedge fund firm. It may require a degree of imagination, but that is what the hedge fund industry is all about.

Comments on this entry are closed.