Hedge funds begin a new year on the heels of a performance record not matched since 2013. Gains will undoubtedly reach 8 percent or better, and assets under management stand at an all-time high.

While these statistics are inspiring, the question on the lips of the aspiring hedge fund professional is what does this mean for bonus and base pay? The best source for answers is the 2018 Hedge Fund Compensation Report.

Base Pay

According to the report, an average $0.38 of each dollar in compensation paid to hedge fund professionals came in the form of base pay, down from $0.41 last year. However, the highest earners, those earning in excess of $1 million, relied substantially less on their base pay, with only $0.17 of every dollar in total compensation coming in the form of base pay. In sharp contrast, those on the lowest rung of the earnings ladder saw base pay account for $0.76 of every dollar earned.

Bonus Pay

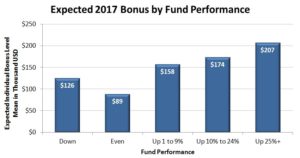

The principal driver for bonus pay is performance. Said performance may be defined as personal performance, fund performance, firm performance or a combination of any of the above. These variables make a direct comparison of one’s total compensation to the overall industry’s performance impossible. For this reason, one of the Hedge Fund Compensation Report segments displays results based upon fund performance.

As we see in the breakdown above, bonus expectations for funds with positive gains increase as anticipated gains rise. The obvious exceptions are found with those working in funds that expect to break even or to experience negative gains.

Bonus expectations are lower, but, nonetheless, they are anticipating bonuses. While this result is counter-intuitive to many, one must consider the methodology by which individual firms calculate bonus pay. For example, bonuses that are based on personal performance can be paid regardless of firm or fund performance when those personal benchmarks are met or exceeded.

The takeaway from this graph is that in 2017, bonus expectations for hedge fund professionals whose funds were performing in positive territory were substantially in line with gains.

Other Factors

Only two factors affecting bonus pay and/or total compensation have been analyzed here. There are many other factors, all of which are available in detail in the 2018 Hedge fund Compensation Report. For example, such variables as firm size, fund size, working group size, method of bonus calculation, fund strategy, and equity sharing, to name a few.

What About Hedge Fund Jobs?

The uptick of overall performance, combined with growing assets under management, can only be viewed as a positive for employment opportunities. However, it is essential that hedge fund job seekers optimize their understanding of hedge fund compensation. This enables job seekers to target firms that present the highest compensation opportunities in line with their skills, experience, educational background and expectations.

At the same time, those responsible for hedge fund hiring will benefit from the report by minimizing lost recruiting opportunities. Having access to the detailed information the 2018 Hedge Fund Compensation Report provides, gives hiring managers the facts needed to make competitive job offers.

Comments on this entry are closed.