The Goldilocks principle states that something must fall within certain margins, as opposed to reaching extremes. As such, it is often associated with the search for life on other planets and explains the phenomenon of life here on planet Earth. In short, life is possible because Earth is neither too hot nor too cold, nor is it not too dry or too wet. However, the principle has broader applications which will interest those angling for a career as a hedge fund professional.

The Goldilocks Principle Applied to Staffing Size

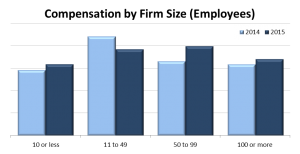

Job Search Digest’s 2016 Hedge Fund Compensation Report provides many valuable insights into the fascinating world of hedge fund compensation, but one of this year’s most surprising is the relationship between the number of employees in a hedge fund firm and their compensation.

Although counterintuitive, survey responses reveal that firms with between 50 and 99 employees award the highest staff compensation. Firms with 11 to 49 employees came in a close second, earning just 3.5 percent less than their peers in the larger firm. Small firms, those with 10 or less employees, fare the worst in overall compensation, earning some 20 percent less that the best performing group. This 2015 compensation pattern is similar to 2014 results, suggesting that those seeking the biggest pay-day will not necessarily find it in the largest firms.

Although counterintuitive, survey responses reveal that firms with between 50 and 99 employees award the highest staff compensation. Firms with 11 to 49 employees came in a close second, earning just 3.5 percent less than their peers in the larger firm. Small firms, those with 10 or less employees, fare the worst in overall compensation, earning some 20 percent less that the best performing group. This 2015 compensation pattern is similar to 2014 results, suggesting that those seeking the biggest pay-day will not necessarily find it in the largest firms.

While this addresses fund size in terms of staffing numbers, it is not unreasonable to extrapolate assets under management from these numbers. However, this comprehensive survey requires no such leap of faith; it also views compensation through the lens of assets under management.

The Goldilocks Principle Applied to Assets under Management

The report also breaks down compensation according to assets under management. There are three buckets: 1) less than $100 million, 2) $100 million to 1$1 billion, 3) more than $1 billion. Not surprisingly, overall compensation at the extremes is below that of the “just right” group that works in funds of $100 million to $1 billion. The largest hedge funds pay 4.66 percent less in total compensation than mid-range funds and the smallest funds pay 41.92 percent less than the mid-range funds. The fact that these differences reflect greater compensation disparities than were noted in the comparisons by staffing size can be attributed to the broader view the report takes of firms by staff size—four buckets rather than three.

The Goldilocks Principle Applied to Bonus Pay

Just to clarify, the above comparisons are made on total compensation which includes bonus pay. This segment excludes base salary and examines bonus pay only which interestingly differs only slightly between firms of varying size. However, in terms of bonus pay, those who work with mid-sized firms earn bonuses that average 8.77 percent greater than peers in the largest of hedge funds, and they earn bonuses that are an astounding 64.92 percent more than peers in the smallest firms.

The Take-Away

If compensation is the primary motivational factor for a hedge fund career, the best chance for meeting that goal is to work with a mid-sized hedge fund. Regardless of the method you elect to gauge its size, assets under management or number of employees, fortune favors those that work in the sweet spot of the range—the fund that is not too small and not too big. The one that is “just right”.

Comments on this entry are closed.