Asset flows into hedge funds reached their highest level in two years according to a recent report by BarclaysHedge.

In total, flows into hedge funds reached $18.8 billion in May, bringing total assets under management to about $1.9 trillion. The $18.8 billion inflow comes on top of $430 million in cash inflow for April and the largest since February 2011, when cash inflow amounted to $25.4 billion.

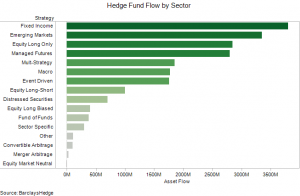

Additionally, BarclaysHedge reports that fund of hedge funds saw a net increase of $428 million in cash position, or about a tenth of one percent increase in total assets. The net cash inflow to fund of hedge funds is important because it broke a 14-month string of net cash outflows. On the whole, fund of hedge funds have seen their net cash position (cash inflow less cash outflow) decline by about $16 billion through the first five months of 2013, an increase of about $5.9 billion from the first five months of 2012. Perhaps interestingly, fixed income funds experienced the largest cash inflow at around $3.8 billion, followed by Emerging Markets close to $3.4 billion, Equity Long-Only near $2.9 billion, and Managed Futures at approximately $2.8 billion. On the opposite side of the cash flow spectrum, Equity Market Neutral funds saw a small outflow (the only sector to see a cash outflow), with Merger Arbitrage and Convertible Arbitrage experiencing less than $100 million in net investment cash flow.

The report provides some interesting insight into what investors were thinking through the month of May, a month in which the S&P 500 saw a healthy 2 percent increase. In looking at the interesting details, here are three general observations:

- First, the fact that hedge fund investors poured more into fixed income than any other strategy indicates that hedge fund investors saw a market correction on the horizon. At the same time, International Strategy and Investment was reporting that hedge fund managers invested long-equity at the highest percentage of assets under management since the beginning of the year. Perhaps more interestingly, hedge fund mangers have been more or less right compared to hedge fund investors.

- The second interesting observation is that Emerging Markets strategy funds saw a larger net cash flow than Equity Long. This is interesting because hedge fund mangers have generally been less intrigued by emerging market opportunities, instead opting for equities in developed countries in recent months. Essentially, at a time when hedge fund managers are becoming more risk-averse to international equities and more invested in domestic equities, hedge fund investors’ top two investment strategies have been fixed income and emerging markets.

- The third observation is that net cash flow to Equity Market Neutral funds was generally flat, with this happening at a time when there is greater downside than upside risk. Therefore, there are greater opportunities to hedge in various sectors, countries, and so forth.

Overall, net asset flows into hedge funds amounted to about $18.8 billion for the month of May, representing the largest cash inflow month since February 2011. In terms of cash inflow by strategy, hedge fund managers and hedge fund investors appear to have some conflicting views on the future of the market, with hedge fund managers generally more accurate through the first couple weeks of July.

Comments on this entry are closed.