One sees the adjective happy, in daily use, in many contexts. It may characterize a feeling, causing a sense of satisfaction, a willingness to perform a task, an unexpected pleasure, a greeting, and even a description of slight intoxication.

The connotation most appropriate to describing one’s job in the hedge fund industry encompasses all these, except the last two.

Happiness Is a Universal Goal

Happiness is important, so much so, that it appears in the Declaration of Independence as one of three principal inalienable rights. After all, who doesn’t want to be happy in their chosen profession, their life and their relationships?

Unfortunately, happiness is a subjective term and, more to the point, the definition of happiness varies from one person to another, much like the idiom “one man’s trash is another man’s treasure”.

Fortunately, the 2018 Hedge Fund Compensation Report has real insights into the illusive state of happiness, and what factors are most likely to engender it, at least among hedge fund professionals.

What the Report Reveals

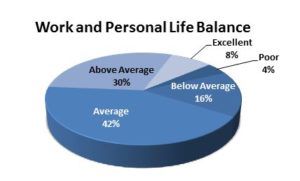

As stated earlier, the concept of happiness has multiple contexts. Happiness, in terms of a feeling, is addressed in the report by asking participants how they view their work/life balance.

As we see in the chart below, 80 percent of hedge fund professionals view their feelings regarding work/life balance as average to excellent, while just one in five regard their experience as below average to poor.

This result suggests a generally positive sentiment with regard to the influence of work on familial and other interpersonal relationships.

This result suggests a generally positive sentiment with regard to the influence of work on familial and other interpersonal relationships.

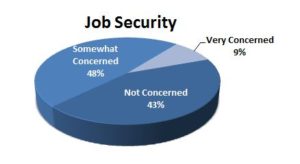

Job Security

It is impossible to imagine that one could be happy in a job that may end at any moment. The 2018 Hedge Fund Compensation Report has polled its participants in this regard with the following results.

As the chart demonstrates, less than 10 percent of hedge professionals express serious concerns with regard to job security. While one must concede that this is not a measure of happiness, it must also be agreed that job insecurity is not a source of happiness, but rather, an impediment to said happiness.

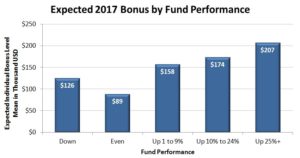

Compensation

This brings us to the “holy grail” of happiness—money! Revealed in the chart below is the fact that less than one-half, in fact, just 4 in 10 hedge fund professionals are satisfied with the level of total compensation they receive. But honestly, would you expect any other result from hedge fund professionals?

To most in the industry, satisfaction is synonymous with complacency. For this reason, we see the above result. No hedge fund investor wants to bet his financial future on a complacent firm. Investors want firms that strive to achieve the highest possible gains within the risk model to which they have agreed.

It follows that those hedge fund professionals exhibiting the will to achieve the best possible gains for their investors will also want the highest possible compensation for their efforts.

Final Thoughts

In the 2018 Hedge Fund Compensation Report there are additional charts clearly showing that the level of compensation satisfaction rises in direct proportion to the level of overall compensation, proving once again that cash is king.

However, the level of happiness one achieves as a hedge fund professional depends on how much weight one places on work/life balance, job security and, of course, compensation.

{ Comments on this entry are closed }