The suggestion that assets under management are soaring is admittedly a bit Trumpian, but the fact is that the number of hedge funds shrank to 9,803 (including funds of funds) while 2016 industry assets under management climbed to just over $3 trillion according to the HFR Market Microstructure Report.

What Can Be Inferred From the Report?

If the number of hedge funds is shrinking at the same time hedge fund assets under management (AUM) rise, then it stands to reason that those firms remaining are becoming larger. More dollars spread among fewer firms can result in no other outcome.

In January 2017, hedge fund redemption slowed to $5.2 billion, a figure that represents about one-quarter of the outflows suffered in January 2016. Suffered may not be the correct adjective because we must also infer that many of these redeemed funds are being redirected to hedge funds with superior performance metrics. Otherwise, how is the growth of AUM to be rationalized?

How Will This Affect Hedge Fund Compensation?

For insights into the effect of larger firms on hedge fund compensation, we look to the 2017 Hedge Fund Compensation Report.

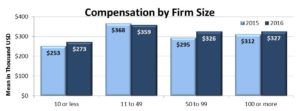

As the chart shows, mean compensation begins to trend lower in larger firms, those with fifty or more employees. One can expect investors to redeem from firms that have failed to meet expectations and invest in higher performing firms. However, that does not mean that these investment dollars will necessarily flow to the largest firms. Countless hedge fund firms, with fewer than fifty employees, boast stellar performance records. As a result, they will attract their share of investors.

Nonetheless, as underperformers shutter and the total number of hedge fund firms continues to decrease, the growth of even the smallest firms is all but guaranteed. If the trend toward lower compensation in larger firms, as shown in the chart above, were to continue, then it would be reasonable to speculate that hedge fund compensation overall will undergo a decline.

There are too many factors in play which could impact the industry, therefore it would be irrational to predict this outcome since we know the paradigm in which the above chart exists may be radically different from tomorrow’s.

What Is the Impact on Jobs?

We all understand that swings in assets under management do not necessarily mandate adjustments in staffing, but those who lose their positions because of firm closure could face increased challenges in their quest to gain purchase with another firm.

Comments on this entry are closed.