In most professional environs, back to back years of meager performance, are likely to raise serious job security concerns among employees. However, among hedge fund professionals, this passes as faulty logic.

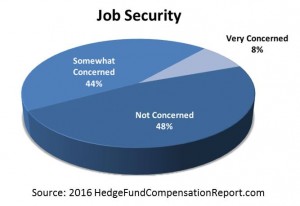

According to the 2016 Hedge Fund Compensation Report, a meager 8 percent of hedge fund professionals participating in the survey identified as being very concerned about job security. Equally stunning is the fact that 48 percent of respondents do not view job security as a concern of any magnitude. The remaining 44 percent acknowledges being somewhat concerned.

According to the 2016 Hedge Fund Compensation Report, a meager 8 percent of hedge fund professionals participating in the survey identified as being very concerned about job security. Equally stunning is the fact that 48 percent of respondents do not view job security as a concern of any magnitude. The remaining 44 percent acknowledges being somewhat concerned.

Really…Only Somewhat Concerned?

This statistic is clear evidence of the supremely confident mindset of the hedge fund professional.

Despite real fund performance issues, constant assaults on management and performance fees, mindless income tax rate comparisons, formidable regulatory pressures and daily doses of unflattering media coverage, most hedge fund professionals (92 percent) are confident in their value to their respective firms.

Job Security vs. Job Satisfaction

Many will expect to see a strong correlation between job security and job satisfaction. However, the aforementioned Compensation Report reveals quite the opposite. Although 92 percent of the survey’s respondents were largely positive with respect to their job security, 56 percent of these hedge fund professionals define themselves as unhappy with their level of compensation.

What’s in the Cards for 2016?

First quarter returns for hedge funds, in the aggregate, are in negative territory. Troubling as this may be, even more troubling is the fact that the New York City Employees Retirement System (NYCERS) has voted to abandon hedge funds as an investment vehicle. Citing the 1.88 percent loss its hedge fund investment experienced last year, NYCERS will redeem $1.45 billion.

The New York City Employees Retirement System’s hedge fund investment is about 2.75 percent of its $53 billion portfolio. Not surprisingly, precious few media reports on the subject acknowledge that hedge fund returns for NYCERS over the past three years averaged a positive 2.83 percent. While this three-year return is hardly the stuff of legend, it does place NYCERS decision in a different light. Even the amateur investor understands the value of a track record in making investment decisions.

Hedge Fund Jobs

While the NYCERS choice is troubling, it is no more significant in its consequences than was the CalPERS decision or more recently, AIG’s redemption announcements. In their totality, it is reasonable to identify this as a trend and the trend is beyond troubling.

The hedge fund industry can and will rationalize these events, dismissing these redemptions as inconsequential in the grand scheme of things. However, they may do so at their peril. While it is true that, as a percentage of assets under management, these redemptions are drops in a barrel, the industry must acknowledge that even a barrel that leaks only “drops” will empty its contents over time.

As anyone following Showtime’s Billions can tell you, there are reasons Bobby Axelrod has a full-time psychiatrist on the payroll.

Comments on this entry are closed.